Effective Interest Methods

The system uses a specific effective interest method to calculate the effective interest for a financial transaction.

The various effective interest methods differ with regard to the following criteria used for the comparison account in the system:

Interest calculation type (linear or exponential)

For more information, see Linear Interest Calculation and Exponential Interest Calculation.

Interest calculation method (for example, 30/360, act/365)

For more information, see Interest Calculation Methods.

Interest capitalization event

The following table provides an overview of all the effective interest methods supported by financial mathematics.

Overview of Effective Interest Methods

Number |

Effective Interest Method |

Interest Calculation Type |

Interest Capitalization |

Interest Calculation Method |

Use |

1 |

PAngV |

Linear |

Annual, starting from the start of the comparison account |

30/360 |

Obsolete (previously Germany) |

2 |

AIBD/ISMA |

Exponential |

On each payment date |

Can be defined freely |

International |

3 |

Braess |

Linear |

Annual, starting from the end of the comparison account |

30/360 |

Germany |

4 |

Moosmueller |

Linear |

On each payment date |

Can be defined freely |

Germany |

5 |

US Treasury |

Linear |

On each payment date |

Can be defined freely |

United States |

6 |

EU Act/365 |

Exponential |

On each payment date |

act/365 |

EU |

7 |

Bond Formula |

Exponential |

On each payment date |

act/actP |

International |

8 |

EU 30.42/365 |

Exponential |

On each payment date |

30.42/365 |

EU |

9 |

Linear |

Linear |

Once, at the end of the comparison account |

Can be defined freely |

Technical |

10 |

U.S. APR |

Linear |

On each payment date |

Dependent on unit period |

United States |

The following example illustrates the comparison accounts for all the effective interest methods supported by financial mathematics and outlines the differences between them.

A bank's customer takes out a loan for EUR 100,000 with a discount of 2%. Interest is calculated at a rate of 5.5% per year using the interest calculation method 30/360. The customer pays interest in arrears every six months and repays the loan in full at the end of the term. This results in the following nominal cash flow:

Nominal Cash Flow for Underlying Transaction

Due Date |

Operation |

Amount |

Remaining Capital |

February 12, 2000 |

Nominal capital |

100,000 |

100,000 |

February 12, 2000 |

Discount |

-2,000 |

100,000 |

July 1, 2000 |

Interest |

-2,123.61 |

100,000 |

January 1, 2001 |

Interest |

-2,750 |

100,000 |

July 1, 2001 |

Interest |

-2,750 |

100,000 |

July 1, 2001 |

Repayment |

-100,000 |

0 |

1. Effective Interest Method: PAngV

This effective interest method was defined by the German regulation on price transparency ("Preisangabenverordnung" – PAngV). This regulation specifies which costs have to be included in the effective interest rate calculation as factors affecting the price.

If the fixed interest period differs from the end of the term, the effective interest rate is referred to as the initial effective annual interest rate.

The criteria for management of the comparison account are:

Linear interest calculation

Interest calculation method: 30/360

Interest capitalized after one year of the contract term, starting on the day of the first turnover on the comparison account (such as the loan disbursement amount). The broken period is at the end of the determination period.

PAngV states that as of September 1, 2000 the effective interest rate has to be calculated using the effective interest method EU-30.42/365.

Comparison Account: Effective Interest Rate 7.12895% PAngV

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

139 |

2,697.52 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

180 |

3,417.49 |

January 1, 2001 |

Interest payment |

-2,750 |

93,126.39 |

41 |

756.10 |

February 12, 2001 |

Interest capitalization |

6,871.11 |

99,997.50 |

139 |

2,752.50 |

July 1, 2001 |

Repayment |

-100,000 |

-2.50 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-2,752.50 |

||

July 1, 2001 |

Interest capitalization |

2,752.50 |

0.00 |

2. Effective Interest Method: AIBD/ISMA

This effective interest method was introduced by the Association of International Bond Dealers (AIBD) and is known as rule 603 of the AIBD. The association is now known as the International Securities Market Association (ISMA), so the method is referred to today as the ISMA method.

The criteria for management of the comparison account are:

Exponential interest calculation

Interest calculation method: 30/360, for example

Interest capitalized on each payment date

Comparison Account: Effective Interest Rate 7.17016% AIBD/ISMA

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

||

February 12, 2000 |

Interest capitalization |

0 |

98,000 |

139 |

2,655.60 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

||

July 1, 2000 |

Interest capitalization |

2,655.60 |

98,531.99 |

180 |

3,471.30 |

January 1, 2001 |

Interest payment |

-2,750 |

95,781.99 |

||

January 1, 2001 |

Interest capitalization |

3,471.30 |

99,253.29 |

180 |

3,496.71 |

July 1, 2001 |

Repayment |

-100,000 |

-746.71 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-3,496.71 |

||

July 1, 2001 |

Interest capitalization |

3,496.71 |

0.00 |

3. Effective Interest Method: Braess

The Braess effective interest method was developed originally for the area of securities. As opposed to the PAngV method, this method puts the broken period at the start of the comparison account.

The criteria for management of the comparison account are:

Linear interest calculation

Interest calculation method: 30/360

Interest capitalized after one year of the contract term, starting on the day of the last turnover on the comparison account (such as the last coupon for a bond). The broken period is at the start of the determination period.

Comparison Account: Effective Interest Rate 7.12665% Braess

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

139 |

2,696.65 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

||

July 1, 2000 |

Interest capitalization |

2,696.65 |

98,573.04 |

180 |

3,512.48 |

January 1, 2001 |

Interest payment |

-2,750 |

95,823.04 |

180 |

3,414.49 |

July 1, 2001 |

Repayment |

-100,000 |

-4,176.96 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-6,926.96 |

||

July 1, 2001 |

Interest capitalization |

6,926.97 |

0.01 |

4. Effective Interest Method: Moosmueller

The Moosmueller effective interest method was developed for the area of securities.

The criteria for management of the comparison account are:

Linear interest calculation

Interest calculation method: 30/360, for example

Interest capitalized on each payment date

The interest rate resulting from the comparison account is the periodic interest rate per year. The system converts the period interest rate into the annual interest rate, which is used to represent the effective interest rate.

Comparison Account: Effective Interest Account 7.16187% MOOSM, Periodic Interest Rate Per Year 7.03803%

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

139 |

2,663.11 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

||

July 1, 2000 |

Interest capitalization |

2,663.11 |

98,539.50 |

180 |

3,467.62 |

January 1, 2001 |

Interest payment |

-2,750 |

95,789.50 |

||

January 1, 2001 |

Interest capitalization |

3,467.62 |

99,257.12 |

180 |

3,492.87 |

July 1, 2001 |

Repayment |

-100,000 |

-742.88 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-3,492.88 |

||

July 1, 2001 |

Interest capitalization |

3,492.87 |

0.01 |

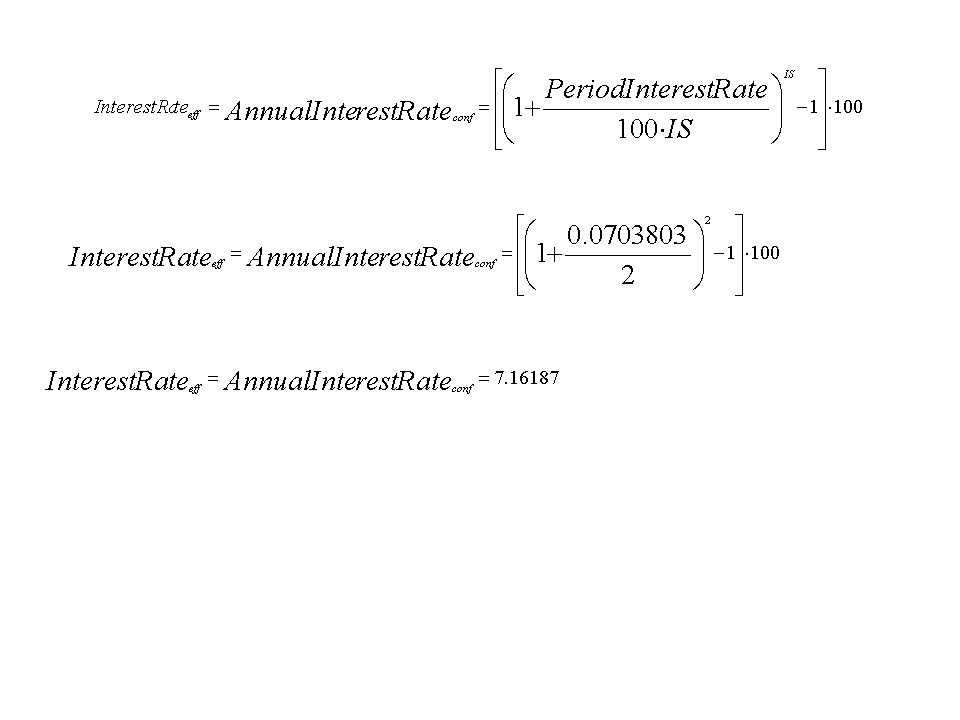

The periodic interest rate per year is 7.03803%. The system uses the following formula to convert this into the annual interest rate (IS represents the number of interest settlements per year).

5. Effective Interest Rate: US Treasury

This effective interest method is used primarily in the United States.

The criteria for management of the comparison account are:

Linear interest calculation

Interest calculation method: 30/360, for example

Interest capitalized on each payment date

Comparison Account: Effective Interest Rate 7.03803% U.S. TR

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

139 |

2,663.11 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

||

July 1, 2000 |

Interest capitalization |

2,663.11 |

98,539.50 |

180 |

3,467.62 |

January 1, 2001 |

Interest payment |

-2,750 |

95,789.50 |

||

January 1, 2001 |

Interest capitalization |

3,467.62 |

99,257.12 |

180 |

3,492.87 |

July 1, 2001 |

Repayment |

-100,000 |

-742.88 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-3,492.88 |

||

July 1, 2001 |

Interest capitalization |

3,492.87 |

-0.01 |

6. Effective Interest Method: EU Act/365

This effective interest method is based on EU Guideline 98/7/EC of the European Parliament and European Council of February 16, 1998, which stipulates that the effective interest rate is to be calculated using the internationally recognized AIBD/ISMA method and the interest calculation method act/365.

The criteria for management of the comparison account are:

Exponential interest calculation

Interest calculation method: act/365

Interest capitalized on each payment date

Comparison Account: Effective Interest Rate 7.18358% EU Act/365

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

||

February 12, 2000 |

Interest capitalization |

0.00 |

98,000 |

140 |

2,642.66 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

||

July 1, 2000 |

Interest capitalization |

2,642.66 |

98,519.05 |

184 |

3,506.32 |

January 1, 2001 |

Interest payment |

-2,750 |

95,769.05 |

||

January 1, 2001 |

Interest capitalization |

3,506.32 |

99,275.37 |

181 |

3,474.63 |

July 1, 2001 |

Repayment |

-100,000 |

-724.63 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-3,474.63 |

||

July 1, 2001 |

Interest capitalization |

3,474.63 |

0.00 |

7. Bond Formula

This effective interest method is used internationally to evaluate bonds.

The criteria for management of the comparison account are:

Exponential interest calculation

Interest calculation method: act/actP

Interest capitalized on each payment date

Comparison Account: Effective Interest Rate 7.05398% Bond Formula

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

||

February 12, 2000 |

Interest capitalization |

0.00 |

98,000 |

140 |

2,648.14 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

||

July 1, 2000 |

Interest capitalization |

2,648.14 |

98,524.53 |

184 |

3,474.95 |

January 1, 2001 |

Interest payment |

-2,750 |

95,774.53 |

||

January 1, 2001 |

Interest capitalization |

3,474.95 |

99,249.48 |

181 |

3,500.52 |

July 1, 2001 |

Repayment |

-100,000 |

-750.52 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-3,500.52 |

||

July 1, 2001 |

Interest capitalization |

3,500.52 |

0.00 |

As opposed to the AIBD/ISMA method, this effective interest method uses exponential interest calculation with periodic interest settlement during the year. The abbreviation "IS" stands for the number of interest settlements per year.

The interest amount of EUR 2,648.14 on February 12, 2000 is calculated as follows:

The interest amount of EUR 3,474.95 on July 1, 2000 is calculated as follows:

The interest amount of EUR 3,500.52 on January 1, 2001 is calculated as follows:

8. Effective Interest Method: EU 30.42/365

The effective interest method is based on EU Guideline 98/7/EC of the European Parliament and European Council of February 16, 1998.

The criteria for management of the comparison account are:

Exponential interest calculation

Interest calculation method: 30.42/365

Interest capitalized on each payment date

The effective interest rate according to EU-30.42/365 is calculated using the present values. Interest is calculated at the same calculation time for all individual payments (t0); in this case, on February 12, 2000. The system uses iteration to calculate the effective interest rate at which the total of all present values is zero. This interest rate is also known as the actuarial return or internal rate of return (IRR).

We are looking for the interest rate for which the following mathematical requirements are met:

The net present value (NPV) of all discounted payments is zero.

The present value (PV) is the discounted final value of a payment on the present date.

In the example, the system determines that all the above mathematical requirements are met if the interest rate is 7.17413. The net present value of 0.01 is the result of rounding differences. The following table shows the history of the present value determination.

Present Value History: Effective Interest Rate 7.17413% EU 30.42/365

Event |

Operation |

Amount |

Days |

Present Value |

Net Present Value = Σ Present Values |

t0 February 12, 2000 |

Incoming payment |

98,000 |

0.00000 |

98,000 |

98,000 |

t1 July 1, 2000 |

Disbursement |

-2,123.61 |

140.66667 |

-2,067.66 |

95,932.34 |

t2 January 1, 2001 |

Disbursement |

-2,750 |

323.16667 |

-2,586.37 |

93,345.97 |

t3 July 1, 2001 |

Disbursement |

-2,750 |

505.66667 |

-2,498.31 |

90,847.66 |

t3 July 1, 2001 |

Disbursement |

-100,000 |

505.66667 |

-90,847.65 |

0.01 |

The following figure shows the present value determination using a time stream:

For example, how does the system calculate the present value of EUR 2,067.66 if t1 is July 1, 2000 and the interest rate is 7.17413%?

A payment of EUR 2,123.61 is made on July 1, 2000. How much is this payment worth on February 12, 2000?

First, the system determines the number of days between February 12, 2000 and July 1, 2000 using February 12, 2000 as the starting point. This means that the broken period is at the end of the time period. The system counts four complete months from February 12, 2000 to June 12, 2000 and 19 calendar days from June 12, 2000 to July 1, 2000. A full month is 365/12 days. This results in the following quotient:

The system assumes the following values:

End value = 2,123.61

Interest rate = 7.17413

Days = 140.66667

Base days = 365

If you enter these values in the formula for the present value calculation, the resulting present value is EUR 2,067.66.

As with other effective interest rate methods, the system displays the results of the effective interest method EU-30.42/365 in a comparison account:

Comparison Account: Effective Interest Rate 7.17413% EU 30.42/365

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

||

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

140.66667 |

55.95 |

July 1, 2000 |

Interest capitalization |

55.95 |

95,932.34 |

||

January 1, 2001 |

Interest payment |

-2,750 |

93,182.34 |

323.16667 |

163.63 |

January 1, 2001 |

Interest capitalization |

163.63 |

93,345.97 |

||

July 1, 2001 |

Repayment |

-100,000 |

-6,654.03 |

505.66667 |

9,152.35 |

July 1, 2001 |

Interest payment |

-2,750 |

-9,404.03 |

505.66667 |

251.69 |

July 1, 2001 |

Interest capitalization |

9,404.04 |

0.01 |

9. Effective Interest Method: Linear

The criteria for management of the comparison account are:

Linear interest calculation

Interest calculation method: 30/360, for example

Interest capitalized once at the end of the comparison account

Comparison Account: Effective Interest Rate 7.27187% Linear

Date |

Operation |

Amount |

Balance |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

||

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

139 |

2,751.59 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

180 |

3,486 |

January 1, 2001 |

Interest payment |

-2,750 |

93,126.39 |

180 |

3,386.02 |

July 1, 2001 |

Repayment |

-100,000 |

-6,873.61 |

||

July 1, 2001 |

Interest payment |

-2,750 |

-9,623.61 |

||

July 1, 2001 |

Interest capitalization |

9,623.61 |

0.00 |

10. Effective Interest Method: U.S. APR

The effective interest method is based on the American Truth in Lending Act (TILA) of 1968, which is also known as Regulation Z.

The criteria for management of the comparison account are:

Linear interest calculation

Interest calculation method depends on unit period

Interest capitalized on each payment date

The system calculates the effective interest rate according to U.S. APR using the present values. Interest is calculated at the same calculation time for all individual payments (t0); in this case, on February 12, 2000. The system uses iteration to calculate the effective interest rate at which the total of all present values is zero.

As with other effective interest rate methods, the system displays the results of the effective interest method U.S. APR in a comparison account:

Comparison Account: Effective Interest Rate 7.05261% U.S. APR

Date |

Operation |

Amount |

Remaining Capital |

Days |

Interest |

February 12, 2000 |

Discount |

-2,000 |

-2,000 |

0 |

0.00 |

February 12, 2000 |

Incoming payment |

100,000 |

98,000 |

0 |

0.00 |

July 1, 2000 |

Interest payment |

-2,123.61 |

95,876.39 |

138 |

55.90 |

July 1, 2000 |

Interest capitalization |

55.90 |

95,932.29 |

0 |

0.00 |

January 1, 2001 |

Interest payment |

-2,750 |

93,182.29 |

318 |

163.59 |

January 1, 2001 |

Interest capitalization |

163.59 |

93,345.88 |

0 |

0.00 |

July 1, 2001 |

Interest payment |

-2,750 |

90,595.88 |

498 |

251.69 |

July 1, 2001 |

Interest capitalization |

251.69 |

90,847.57 |

0 |

0.00 |

July 1, 2001 |

Repayment |

-100,000 |

-9,152.43 |

498 |

9,152.43 |

July 1, 2001 |

Interest capitalization |

9,152.43 |

0.00 |

0 |

0.00 |

For more information, see Effective Interest Rate Calculation According to U.S. APR.

Comparison Account